how to avoid estate tax in california

24 Disclaim the inheritance altogether. This will allow you to avoid probate for virtually anything of value you own.

5 Reasons You Should Sell Your Mobile Home To Sell Thy House In Southern California Avoid Foreclosure Sell My House Sell My House Fast

Different states however offer different ways to avoid probate.

. For instance the 133 percent income tax bracket applies to a net income over 1 million. September 21 2021 by Werner Law Firm. It is also common for California residents to change residency to avoid being tax for the sale of a substantial business.

Similarly the proposed 04 percent wealth tax would only be applicable for those with incomes above. When does inheritance become taxable. For estates that exceed this amount the top tax rate is 40.

These rates are set out in Probate Code 10800 and 10810 4 percent on the first 100000 3 percent on the next 100000 2 percent on the next 800000 and so on. No California estate tax means you get to keep more of your inheritance. California property owners are getting older.

Blessed is the hand that gives indeed. For 2021 the annual gift-tax exclusion is 15000 per donor per recipient. Here are your options in California.

With careful planning gifting can be an excellent way to avoid probate and simplify your estate. Both state and federal taxes may be levied on your estate depending on its total value at the. In California these fees are calculated as a percentage of the gross not net value of the assets in the estate.

You need to create a trust. For some people a substantial inheritance could result in that persons estate exceeding the lifetime exemption amount meaning they would ultimately owe taxes on their estate. The new combined annual property tax will be 50000.

The surest way to avoid or reduce estate taxes in California and other states is to give off portions of your estate as gifts to your beneficiary. 21 Sell the property as fast as you can. Learning how to avoid probate in California is essential.

The gift tax exemption threshold is 15000 in 2021. For those interested in Estate Planning here in California you should likely set up a living trust. Property transfer taxes are derived from the selling price of your home.

Some states have enacted inheritance taxes on estates of any size. Some clients decide to disclaim an inheritance in order to avoid the potential of owing estate taxes when they die. The anticipated hike would raise the rates to 143 on incomes over 1 million 163 on incomes over 2 million and 168 on incomes over 5 million.

If you itemize deductions you can take a tax deduction for any charitable donations made while youre living. For a married couple filing jointly the. Take the right steps by reducing the estate joint ownership and leveraging trusts.

The following are your options to avoid probate here in California. California does not levy a gift tax. A full chart of federal estate tax rates is below.

With the exception of the estate tax for estates exceeding 1158 million dollars per person California does not have a state-level inheritance tax. The exemption can essentially equal 250000 for a single person and a married person filing separately. How to Avoid Estate Tax 10 Techniques.

For instance a company based in Arizona but with assets and operations in California is to be sold for 10-million. The current exemption amount is 545 million. 23 Defer your taxes as an investment property.

22 Make the property your primary residence. The probate process can be lengthy costly and stressful. Gift Money To Your Kids.

There are several ways to accomplish this. Ad From Fisher Investments 40 years managing money and helping thousands of families. Doing so may help to keep them out of your estate which means that they avoid probate.

Fortunately there is also an exemption built into the various tax laws known as the capital gains real estate tax exemption. However this may not be the case if you forget to add a beneficiary to a given asset or list a beneficiary who is not legally capable of inheriting property. This goes up to 1206 million in 2022.

Minimize retirement account distributions. The easiest thing to do is to give money away. What Are the Legal Options to Avoid Estate Tax in California.

Set Up A Living Trust to Avoid Probate In California. Charitable contributions can also reduce the value of your estate and help you reduce or avoid estate taxes. The larger and more complicated the estate the more these adjectives apply.

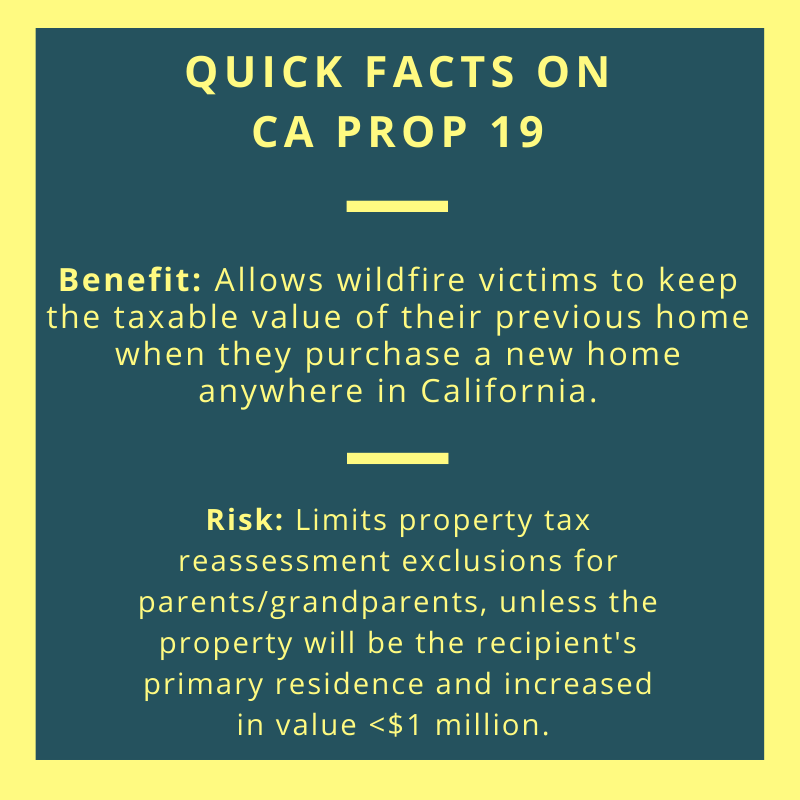

The key to property tax relief in all 58 counties in California. If you plan to gift your real estate to your children or grandchildren start planning now to avoid leaving them with a large property tax burden. The estate tax applies to.

The share of homeowners over 65 increased from 24 percent in 2005 to 31 percent in 2015. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. This tax has full portability for married couples meaning if the right legal steps are taken a married couple can avoid paying an estate tax on up to 2406 million after both have died.

California sales tax rates range from 735 to 1025. For a home owned this long the inheritance exclusion reduces the childs property tax bill by 3000 to 4000 per year. There are a few ways individuals can protect their beneficiaries from inheritance tax.

In some cases an executor might just have a different alternate valuation date which is 6 months following. If your inheritance is in Trust a portion of the income might be subject to. There is no such thing as a state-level estate or inheritance tax in the state of CaliforniaYou do not have to be concerned about having to pay an inheritance tax on the money that you get from the estate of a deceased individual if you are a resident of the state of CaliforniaAt this time individuals who inherit money are required to pay an inheritance tax to only six different.

Up to 25 cash back Its no wonder so many people take steps to spare their families the hassle. That is not true in every state. One way to avoid probate in California is to use a living trust.

Californians are still able to successfully avoid property tax reassessment by inheriting CA property taxes from parents in the final analysis keeping a low property tax base when inheriting a home. Probate laws will vary from state to state. The California Revenue and Taxation Code states that all the counties in California have to pay the same rate.

California is quite fair when it comes. However the federal gift tax does still apply to residents of California. 2 How to Avoid Inheritance Tax and Capital Gains Tax in California.

Give to charity while youre alive. This base rate is the highest of any state. In California you can make a living trust to avoid probate for virtually any asset you ownreal estate bank accounts vehicles and so on.

The current tax rate is 110 per 1000 or 055 per 500. In addition to property tax if you would like to learn more about other intergenerational transfer strategies to minimize your estate gift and generation-skipping transfer tax burden contact Jacqueline Yu at. A living trust is a legal document that allows you to.

This clause in the tax law allows 250000 per taxpayer per tax year. Consider the alternate valuation date. So if your home sells for 600000 the property transfer tax is 660.

Number of Inherited Properties Likely to Grow. Weve compiled a list of 10 techniques to help you determine how to avoid estate taxes.

California Estate Tax Everything You Need To Know Smartasset

Pin By Terry Wilson On Wilson Inheritance In 2022 Revocable Living Trust Planning Guide How To Plan

Revocable Living Trust Flow Chart For Estate Planning Revocable Living Trust Living Trust Estate Planning

Bad Map Example No Normalization And Too Many Colors And Categories Income Tax Map Amazing Maps

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

Is Inheritance Taxable In California California Trust Estate Probate Litigation

A California Living Trust Can Help You Avoid A Costly And Stressful Probate Process Https Apeopleschoice Com A Cali Living Trust California Revocable Trust

How To Sell Inherited Property In California Without Hassle

States With No Estate Tax Or Inheritance Tax Plan Where You Die

California Estate Tax Everything You Need To Know Smartasset

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Taxes On Your Inheritance In California Albertson Davidson Llp

Top 4 Gift And Estate Tax Avoidance Strategies Estate Tax Estate Planning Estate Planning Attorney

Fun Facts About Estate Planning Infographic Estate Planning Infographic Estate Planning How To Plan

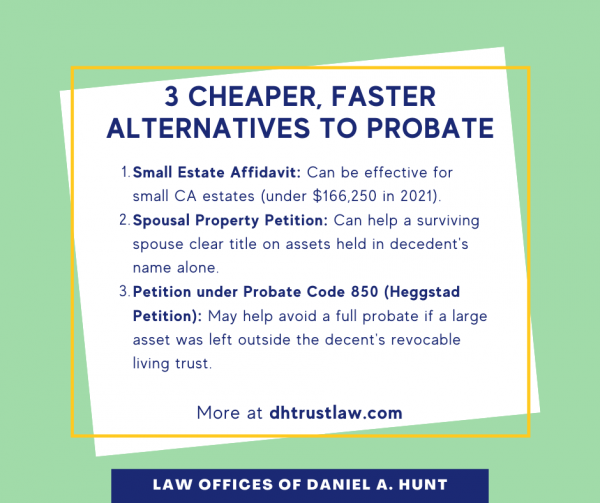

3 Faster Cheaper Alternatives To Probate Law Offices Of Daniel Hunt

California Estate Tax Everything You Need To Know Smartasset

How Prop 19 Could Affect Your Estate Plan Law Offices Of Daniel A Hunt